Trade Crypto for Less Coin

PRODUCTS

Trade Crypto for Less Coin

The IBKR Advantage

- Low commissions on cryptocurrencies - just 0.12% to 0.18% of trade value1 with no added spreads, markups or custody fees

- Commissions on crypto ETPs start $0, while commissions on futures/futures options are just USD 0.25 to USD 0.85 per contract.

- Trade and hold Avalanche, Bitcoin, Bitcoin Cash, Cardano, Chainlink, Dogecoin, Ethereum, Litecoin, Ripple, Solana and Sui.

- Additional features let clients hold USD and cryptocurrencies in their cryptocurrency trading account, trade cryptocurrencies 24/7, place non-marketable limit orders, and withdraw cryptocurrency assets from your Paxos or Zero Hash account to an external wallet.

- Invest in crypto, stocks, options, ETPs, futures, bonds, and more from a single unified platform

- Cryptocurrency trade execution and custody are provided by either Paxos Trust Company or Zero Hash LLC depending on your account type and country of legal residence.

- IBKR Rated Best Online Broker – 2025 Broker Chooser Best Online Brokers2

Cryptocurrency

Low Commissions

0.12% to 0.18% of Trade Value1 with No Added Spreads, Markups or Custody Fees

While other crypto exchanges and brokers charge trading fees as high as 2.00% of trade value or more, and add spreads or markups to the cryptocurrency price, cryptocurrency trading with Paxos or Zero Hash on Interactive Brokers’ platform has a low commission of just 0.12% to 0.18% of trade value1 with a USD 1.75 minimum per order (but the minimum is subject to a cap of 1% of trade value). Plus, there are no added spreads, markups, or custody fees.

Crypto Trading Cost Comparison3

| Fee | IBKR | Gemini ActiveTrader4 |

Robinhood Crypto5 | Fidelity Crypto6 | eToro7 | Coinbase Advanced8 |

|---|---|---|---|---|---|---|

| Crypto Transaction Fee for $1,000 of crypto |

0.18% | 0.40% | None | None | 1.00% | 1.20% |

| Spread / Markup | None | None | 0.85% | 1.00% | None | None |

| Total fee | 0.18% | 0.40% | 0.85% | 1.00% | 1.00% | 1.20% |

| Cost of $1,000 trade | $1.80 | $4.00 | $8.50 | $10.00 | $10.00 | $12.00 |

Discover a World of Investment Opportunities

Clients can trade cryptocurrencies through Paxos or Zero Hash, alongside global stocks, options, futures, spot currencies, bonds, funds and more via the Interactive Brokers platform.

- Commissions just 0.12% to 0.18% of trade value

- Trade and hold AVAX, BTC, BCH, ADA, DOGE, ETH, LINK, LTC, XRP, SOL and SUI

- USD 1.75 minimum per order, capped at 1% of trade value

Additional Features

- Hold USD in your cryptocurrency account

- Trade cryptocurrencies 24/7 when you transfer funds to your dedicated Paxos or Zero Hash account during normal US banking hours.

- Place non-marketable limit orders

Cryptocurrency and Virtual Assets Products trading permissions are needed to trade Avalanche, Bitcoin, Bitcoin Cash, Cardano, Chainlink, Dogecoin, Ethereum, Litecoin, Ripple, Solana and SUI.

Cryptocurrency ETPs

Cryptocurrency ETPs offer investors improved accessibility and exposure to cryptocurrencies purchase the asset. Spot cryptocurrency ETPs hold actual cryptocurrency rather than derivatives tied to the price of the cryptocurrency, meaning the price of the ETPs fluctuates with the price of the cryptocurrency in cryptocurrency markets.1

Available exchange-traded products include:

- GBTC (PINK) Grayscale Bitcoin Investment Trust

- BCHG (PINK) Grayscale Bitcoin Cash Trust

- ETCG (PINK) Grayscale Ethereum Classic Trust

- ETHE (PINK) Grayscale Ethereum Trust

- GDLC (PINK) Grayscale Digital Large Cap Fund

- LTCN (PINK) Grayscale Litecoin Trust

- BITCOINXB (SFB) Bitcoin Tracker One

$0 Commissions or Low Commissions

IBKR Pro

IBKR Pro commissions range from USD 0.0005 to USD 0.0035 per share on ETPs. IB SmartRoutingSM helps support best execution by searching for the best available prices for stocks, options and combinations across exchanges and dark pools.

IBKR Lite

IBKR Lite commissions are $0 on US listed ETPs, with no account minimums and no inactivity fees.

View Commissions Request Trading Permissions

Complex or Leveraged Exchange Traded Products trading permission is needed to trade cryptocurrency ETPs.

Cryptocurrency Futures

Hedge against or gain exposure to market volatility in Bitcoin, Ether or Solana.

Low Futures Commissions

Futures commissions range from USD 0.25 to USD 0.85 per contract, plus exchange, regulatory and carrying fees.

Also Access Micro Cryptocurrency Futures

Micro-sized Contracts. Major Crypto Opportunities.

Micro Bitcoin (MBT), Micro Ether (MET) and Micro Solana futures (MSL) provide an efficient, cost effective way to fine tune cryptocurrency exposure and enhance your trading strategies. Enjoy the features of Bitcoin (BTC), Ether (ETH) and Solana (SOL) futures in a smaller slice that gives active traders more choices for managing bitcoin price risk.

- Trade a Slice of Cryptocurrency Futures

Get the same features as the larger Bitcoin, Ether and Solana contracts at a fraction of its contract size, settled to regulated cryptocurrency benchmarks. - Price Discovery and Transparency

Trade on a regulated exchange and enjoy the price discovery of transparent futures, where all participants see the same prices and quotes.

- Precisely Scale Cryptocurrency Exposure

Add more control over the amount of Bitcoin, Ether or Solana exposure in your trading strategies. - Capital Efficiency in Crypto Trading

Save on potential margin offsets with Bitcoin futures and options, Ether futures and Solana futures, plus add the efficiency of futures contracts

View Commissions Request Trading Permissions

Futures trading permission is needed to trade futures/future options cryptocurrency products.

Cryptocurrency Options on Micro Bitcoin and Micro Ether Futures

CME Options on Micro Bitcoin and Micro Ether Futures offer more ways to manage your exposure to the top cryptocurrencies by market capitalization and can help optimize your crypto trading strategies. Building on the liquidity of Micro Bitcoin and Micro Ether futures, these options contracts offer market participants a way to efficiently hedge market-moving events with greater precision and flexibility, enabling traders of all sizes to access crypto market exposure.

- Trade With More Precision

Scale bitcoin and ether exposure up or down with greater granularity with contracts sized at 1/10 of the underlying tokens. More precision can provide additional control over the risk/reward ratio of your trading strategies.

- Add Versatility To Your Crypto Trading Strategy

Express long- or short-term views with a choice of weekly and monthly expirations. Build market neutral, directional, and/or multi-leg strategies to seek new opportunities in the crypto markets.

- Access Micro Bitcoin and Micro Ether Futures Liquidity

With a lower dollar premium related to the smaller contract size, these options settle into liquid Micro Bitcoin and Micro Ether futures, traded around the clock and around the world.

View Commissions Request Trading Permissions

Futures trading permission is needed to trade futures/future options cryptocurrency products.

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that exists only online. It uses mathematical algorithms and encryption techniques known as cryptography to secure transactions and manage the network. Unlike traditional fiat currencies issued by governments, cryptocurrencies are decentralized and operate on blockchain technology, which is a distributed ledger that records all transactions across a network of computers.

Key features of cryptocurrency include:

- Digital-only

No physical coins or bills. - Decentralized

Most cryptocurrencies are not controlled by a central authority like a bank or government. - Blockchain-based

Transactions are recorded on a transparent and secure ledger. - Cryptographic security

Ensures the integrity of transactions and ownership. - Pseudonymous

Users are identified by digital addresses, not personal names (though not fully anonymous).

Key Cryptocurrency Terms

As an emerging asset class, there are key terms associated with cryptocurrency that you should know:

- Bitcoin: The first and most popular cryptocurrency.

- Blockchain: A digital record book that keeps track of all cryptocurrency transactions. It is shared across many computers, so it is hard to change or hack.

- Wallet: A software program or physical device that stores your cryptocurrency. It lets you send and receive digital coins.

- Private Key: A secret code that gives you access to your cryptocurrency. You must keep it safe and never share it.

- Public Key: A code that works like your digital address. People use it to send you cryptocurrency.

- Mining: The process of using computers to solve puzzles that confirm transactions and add them to the blockchain. People who do this are called miners, and they earn new coins as a reward.

- Exchange: A website or app where you can buy, sell, or trade cryptocurrency using regular money or other digital coins.

- Token: A type of cryptocurrency that is built on another blockchain. Many tokens are used in apps or games or represent things like points or access rights.

- Ethereum: A popular cryptocurrency that lets people create smart contracts and apps that run on the blockchain.

- Smart Contract: A digital agreement written in code. It runs automatically when certain conditions are met.

- NFT (Non-Fungible Token): A special type of digital asset that shows ownership of a unique item, like art, music, or video.

- DeFi (Decentralized Finance): Financial services that work without banks or middlemen. These are built using blockchain technology.

- Gas Fee: A small amount of cryptocurrency you pay to process a transaction or run a smart contract on a blockchain like Ethereum.

- Altcoin: Any cryptocurrency that is not Bitcoin. Examples include Ethereum, Litecoin, and Solana.

- Stablecoin: A type of cryptocurrency that is linked to the value of a real-world asset, like the US dollar. It is made to be less risky and more stable in price.

- Ledger: A record of all transactions. In cryptocurrency, the ledger is digital and usually takes the form of a blockchain.

- Satoshi: The smallest unit of Bitcoin. One Bitcoin equals 100 million satoshis.

- ICO (Initial Coin Offering): A way for new cryptocurrency projects to raise money by selling their coins to investors before launch.

- HODL: A slang term that means to hold on to your cryptocurrency instead of selling it, even when prices go up or down.

How Do I Buy Cryptocurrency?

To purchase cryptocurrency, open an account with a trusted cryptocurrency exchange or an online broker like Interactive Brokers who offers access to cryptocurrency. Once your account is open and funded, you may have to request trading permissions for trading cryptocurrencies and virtual assets products. Choose a cryptocurrency to buy, enter the amount you wish to invest, review commissions and fees, and place your order.

After purchasing your cryptocurrency, you could store it by keeping it on the exchange used to purchase it or transfer it to a crypto wallet.

What Are the Benefits and Risks of Trading Cryptocurrency?

Benefits of Cryptocurrencies

Cryptocurrency offers several benefits to users and investors. It provides the potential for high returns and allows people to access financial markets without needing a traditional bank account. Crypto trading is available 24 hours a day, so investors can buy or sell at any time. Many cryptocurrencies also allow for fast, low-cost transfers across borders. People who buy cryptocurrency often enjoy greater control over their funds and more privacy than with standard banking. In addition, crypto can help diversify a portfolio and support new technologies such as smart contracts and decentralized apps.

Risks of Cryptocurrencies

While cryptocurrency can be rewarding, it also comes with serious risks. Prices can change quickly, which means there is a chance of losing a large portion of your investment. Because the market is still developing, crypto is less regulated than traditional financial systems, which increases the risk of fraud or scams. Some platforms have been hacked, and users who lose their private keys may lose access to their funds permanently. Also, government policies can affect how crypto is taxed or allowed to be used, adding uncertainty for buyers. Like any investment, it is important to understand the risks before getting involved.

Interactive Brokers’ Education and Resources for Cryptocurrencies

Traders’ Insight

Traders’ Insight provides market-related articles and commentary from Interactive Brokers’ employees, exchanges and third-party contributors.

IBKR Webinars

Participate in an upcoming webinar or review previous webinars regarding cryptocurrency.

Professional Trading Platforms and Tools

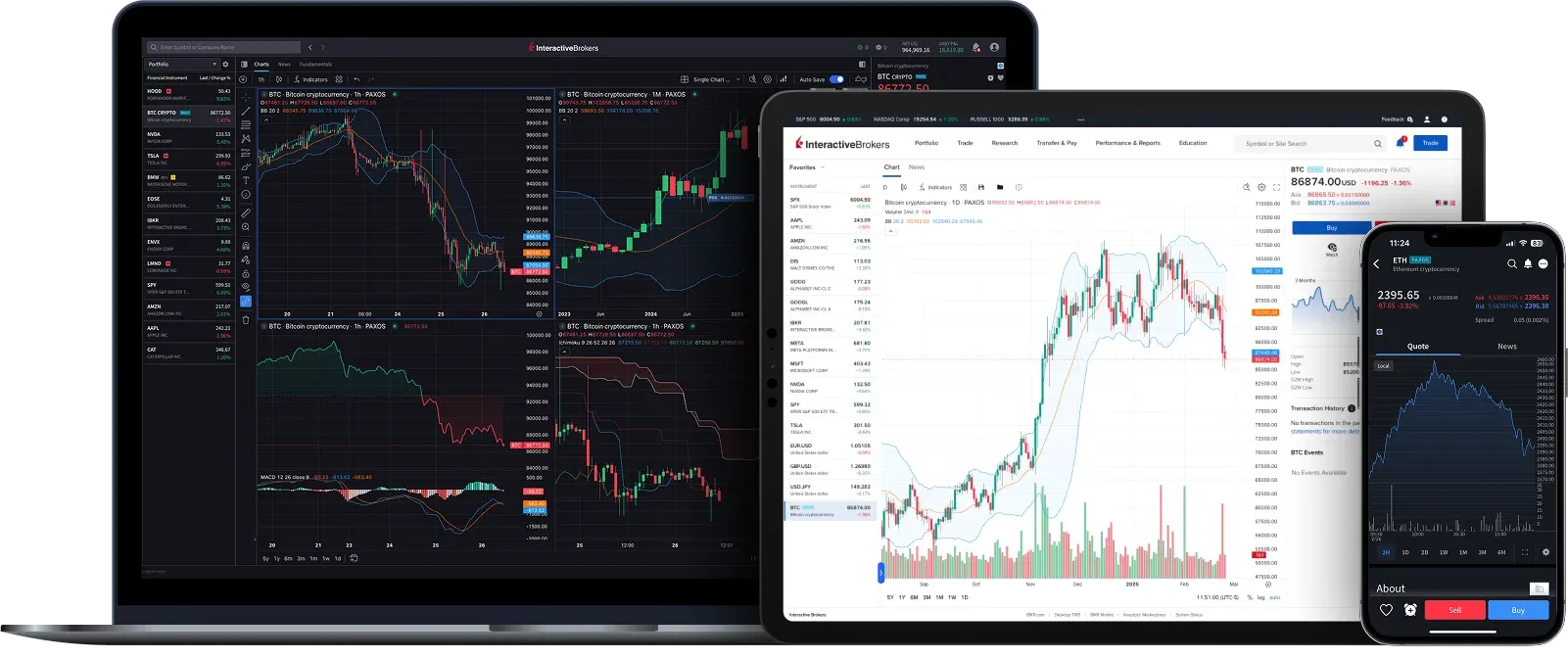

Trading Platforms

Powerful, award-winning trading platforms and tools for managing your portfolio. Available on desktop, mobile, and web.

Trading Tools

Use a full suite of professional trading tools to help make better decisions and manage your portfolio. Spot market opportunities with Advanced Market Scanners and analyze your portfolio with Risk Navigator.

Sustainable Investing

Use Interactive Brokers’ suite of environmental, social and governance (ESG) tools to develop your own conscious investing plan. Align your investments with what you care about most.

Security You Can Trust

Security is crucial to cryptocurrency trading. Use the IBKR platform and funds from your IBKR account to trade cryptocurrencies at either Paxos Trust Company or Zero Hash LLC. Paxos Trust Company is regulated and supervised by the New York Department of Financial Services (the New York bank regulator). Zero Hash LLC is a FinCEN-registered Money Services Business, is licensed as a money-transmitter in various states, and has been granted a BitLicense by the NY Department of Financial Services.

Best for Advanced Traders

Best Online Broker

Interested in Trading Crypto?

Already an Interactive Brokers Client?

Log In Request Trading Permissions

Log in to Client Portal and click the User ("Head/Shoulders" icon) > Settings menu. From the Settings page, click Trading Permissions to request Cryptocurrency trading permission.

Trading permission requests are typically approved overnight.

New to Interactive Brokers?

Interactive Brokers (Nasdaq: IBKR) is an automated global electronic broker that serves individual investors, hedge funds, proprietary trading groups, registered investment advisors and introducing brokers.

Our four-decade focus on technology and automation allows us to provide our clients with a uniquely sophisticated, low-cost global platform for managing investments.

Our clients enjoy low-cost access to stocks, options, futures, currencies, bonds and funds from a single unified platform.

FAQs

Disclosures

-

- INTERACTIVE BROKERS LLC IS A MEMBER OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMINATIONS. HOWEVER, YOU SHOULD BE AWARE THAT NFA DOES NOT HAVE REGULATORY OVERSIGHT AUTHORITY OVER UNDERLYING OR SPOT VIRTUAL CURRENCY PRODUCTS OR TRANSACTIONS OR VIRTUAL CURRENCY EXCHANGES, CUSTODIANS OR MARKETS.

- Trading in digital assets, including cryptocurrencies, is especially risky and is only for individuals with a high risk tolerance and the financial ability to sustain losses. For more information about the risks surrounding the trading of Digital Assets please see the "Disclosure of Risks of Trading Digital Assets".

- IB is not party to any transactions in digital assets and does not custody digital assets on your behalf. All digital asset transactions occur on the Paxos Trust Company ("Paxos") or Zero Hash LLC ("Zero Hash") exchanges. Any positions in digital assets are custodied solely with Paxos or Zero Hash and held in an account in your name outside of IB.

- Digital assets held with Paxos or Zero Hash are not protected by SIPC.

- For more information about eligibility to trade digital assets with Paxos or Zero Hash, please see the FAQ.

- Zero Hash LLC and Zero Hash Liquidity Services LLC are licensed to engage in Virtual Currency Business Activity by the New York State Department of Financial Services.

- RISK DISCLOSURE REGARDING COMPLEX OR LEVERAGED EXCHANGE TRADED PRODUCTS

- TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. Learn more about the risks of trading Bitcoin products.

- Options and Futures: Options and Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading options read the Characteristics and Risks of Standardized Options. Before trading futures, please read the Security Futures Risk Disclosure Statement.

- Although the size of the Micro E-mini contracts are 1/10th the size of their classic E-mini counterparts, pricing may not exactly track the pricing of the E-mini futures.

- Depending on client monthly volume, with a USD 1.75 minimum commission per order (but the minimum is subject to a cap of 1% of trade value).

- For more information, see our awards page.

- All rates as of September 22, 2025. Competitor rates and offers are subject to change without notice. Services vary by firm.

- Gemini ActiveTrader Taker Fee.

- Robinhood Crypto spread added to crypto price.

- Fidelity Crypto spread added to crypto price.

- eToro has a 1% fee for trading cryptocurrencies, which is added to the market price.

- Coinbase Pro Level Intro 1 Taker Fee.